SARFAESI ACT 2002 RIGHTS OF BORROWER

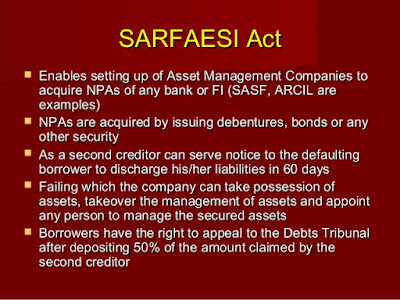

The SARFAESI(The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act) Act 2002

,

gives bank right of seize and desist. Banks

give a notice to the borrower requiring it to pay off loan within 60 days. If the borrower fails to pay

with the notice, after that the Bank may

take the following measures: Take over the security for the loan Sale or lease right over the security Manage the same or

appoint any person to manage the same The SARFAESI Act also a base for Asset Reconstruction Companies (ARC) control

by RBI to acquire assets from banks and

financial institutions.

The Act provides for

sale of financial assets by banks and financial institutions to asset

reconstruction companies (ARC). RBI has issued guidelines to banks on the

process to be followed for sales of financial assets to ARCs.

RIGHTS OF BORROWER

The borrowers can at

any time before the sale is concluded, pay the dues and avoid loosing the security.

The borrowers will get compensation for such acts.

For redressing the

complaint , the borrowers can approach to the DRT and thereafter the DRAT in appeal. The

periods are 45 days and 30 days.

The Act specifies four conditions for enforcing the rights by a

creditor.

The debt must be secured

The debt must be classified as NPA by the banks

The outstanding dues are 1 lakh and above and more than 20%

of the loan amount and interest there

on

The security to be enforced is not an Agricultural land.