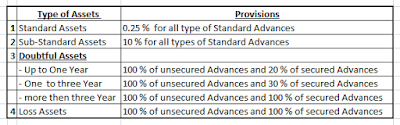

Asset-Classification: The-RBI has issued guidelines-to the banks for classification of assets into four categories.assets classification in banking world

1. Standard Assets: Standard assets are those loans which do

not have any problem or have less risk. A standard asset is a performing asset.

Standard assets generate continuous income and repayments. Such assets carry a

normal risk and are not NPA in the real sense. So that, no special provisions

are required for Standard Assets.

2. Substandard Assets: These assets come under the category of

NPA, which assets are NPA from a period of less than 12 months. All those

assets (loans and advances) which are considered as non-performing for a period

of 12 months are called as Sub-Standard assets.

3. Doubtful Assets: These assets come under the category of

NPA, which assets exceeding more than 12 months.

4. Loss Assets: These NPAs which are identified as unreliable

by internal inspector of bank, external auditors or by RBL All those assets

whose recovery is not possible.