Economic Overview of the United States |financial condition| HISTORY |TRADE |EXPORTS | IMPORTS

Regardless of confronting difficulties at the residential level alongside a quickly changing worldwide scene, the U.S. economy is still the biggest and most critical on the planet. The U.S. economy speaks to around 20% of aggregate worldwide yield, is still bigger than that of China

. Additionally, as indicated by the IMF, the U.S. has the 6th most astounding per capita GDP (PPP), surpassed just by little nations, for example, Norway and Singapore. The U.S. economy includes a very created and innovatively propelled administrations segment, which represents around 80% of its yield. The U.S. economy is commanded by administrations situated organizations in ranges, for example, innovation, money related administrations, social insurance and retail. Extensive U.S. organizations additionally assume a noteworthy part on the worldwide stage, with more than a fifth of organizations on the Fortune Global 500 originating from the United States.

Despite the fact that the administrations area is the primary motor of the economy, the U.S. likewise has an imperative assembling base, which speaks to about 19.9% of yield. The U.S. is the second biggest producer on the planet and a pioneer in higher-esteem businesses, for example, vehicles, aviation, apparatus, media communications and chemicals. In the interim, horticulture speaks to under 2% of yield. In any case, a lot of arable area, propelled cultivating innovation and liberal government sponsorships make the U.S. a net exporter of sustenance and the biggest horticultural trading nation on the planet.

The U.S. economy keeps up its powerhouse status through a mix of qualities. The nation has entry to plentiful regular assets and a modern physical foundation. It additionally has an extensive, knowledgeable and profitable workforce. Besides, the physical and human capital is completely utilized in a free-market and business-situated environment. The legislature and the general population of the United States both add to this extraordinary financial environment. The legislature gives political soundness, a useful legitimate framework, and an administrative structure that permit the economy to prosper. The overall public, including a differences of migrants, brings a strong hard working attitude, and additionally a feeling of business and danger taking to the blend. Monetary development in the United States is always being driven forward by continuous advancement, innovative work and in addition capital venture.

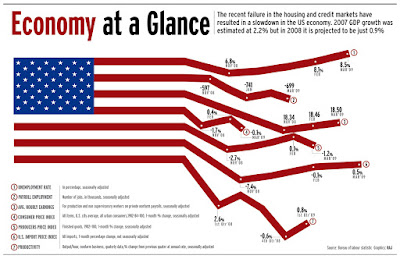

The U.S. economy is as of now rising up out of a time of extensive turmoil. A blend of variables, including low loan fees, far reaching contract loaning, inordinate danger taking in the money related division, high shopper obligation and remiss government direction, prompted a noteworthy subsidence that started in 2007. The lodging market and a few noteworthy banks fallen in 2008 and the U.S. economy continued to contract until the second from last quarter of 2009 in what was the most profound and longest downturn since the Great Depression. The U.S. government mediated by utilizing USD 700 billion to buy pained home loan related resources and propping up huge wallowing enterprises with a specific end goal to balance out the monetary framework. It additionally presented a jolt bundle worth USD 831 billion to be spent over the accompanying 10 years to support the economy.

The economy has been recuperating gradually yet unevenly since the profundities of the retreat in 2009. The economy has gotten further backing through expansionary financial strategies. This incorporates not just holding loan fees at the lower bound, additionally the unusual routine of the administration purchasing tremendous measures of monetary resources for increment the cash supply and hold down long haul financing costs—a practice known as "quantitative facilitating".

While the work market has recuperated altogether and occupation has come back to pre-emergency levels, there is still broad civil argument with respect to the strength of the U.S. economy. What's more, despite the fact that the most noticeably bad impacts of the retreat are currently blurring, the economy still faces an assortment of huge difficulties going ahead. Weakening framework, wage stagnation, rising wage imbalance, lifted benefits and restorative expenses, and also huge current record and government spending shortages, are all issues on the radar.

U.S. economic and Financial History

The end of World War II denoted the start of a brilliant time for the U.S economy. This period was set apart by a surge in financial movement and efficiency, a developing and more prosperous white collar class, and the ascent of the person born after WW2 era. From the late 1940s to the mid 1970s, U.S. Gross domestic product developed at a normal yearly rate of about 4%. By the 1970s, the basic change in the economy far from industry and assembling to administrations was in full compel. Be that as it may, following a very long while of remarkable development, the economy started to hint at abating and a progression of occasions, including the breakdown of the Bretton Woods framework, the 1973 oil emergency and expanded worldwide rivalry, hastened vital financial changes. The 1970s were set apart by a time of stagnating development and expansion alluded to as "stagflation".

The 1980s offered ascend to Reaganomics, a progression of monetary strategies advanced by President Ronald Reagan. The primary destinations were diminished government spending and control, and additionally bring down assessments and a more tightly cash supply. Regan was very fruitful in updating the duty code and pushing ahead with deregulation in a few noteworthy areas of the economy; and while development and profitability expanded, the administration's obligation duplicated altogether. In a more extensive sense, Reaganomics denoted a move in the direction of free-market supply-side financial aspects and far from the Keynsian-propelled financial matters that had been favored since the Great Depression.

Expanding worldwide incorporation and the ascent of new innovation, including the reception of profitability upgrading IT in the work environment and the surge of cutting edge organizations, energized a financial blast in the 1990s. The period somewhere around 1993 and 2001 denoted the longest maintained development in U.S financial history, and fueled a lofty ascent in work, wage and shopper demand.

Additionally, the solid development and low unemployment amid this time were especially amazing on the grounds that the administration spending plan was reigned in at the same time and really accomplished a surplus for a long time somewhere around 1998 and 2001. The financial change was made conceivable to a limited extent by duty increments presented by President Bill Clinton, additionally because of the blasting economy and surging securities exchange. The share trading system was driven up by the ascent of web based organizations in what is known as the "website bubble", which created tremendous totals of unexpected income for the administration on capital additions charges and rising pay rates. Be that as it may, the overvaluation of website stocks in the long run got to be clear and the air pocket burst in 2000.

The main years of the 2000s saw a sharp drop in economy action taking after the website burst. The fear based oppressor assaults on September 11, 2001, and a few corporate scandals put a further damper on financial movement and business certainty. The Federal Reserve (the Fed), under Alan Greenspan, ventured into check the battling economy by presenting low loan costs. This move would later be viewed as a central point in bringing on the monstrous lodging market bubble that burst and accelerated the Great Recession that started in 2008.

United State Balance Of Payment

In the course of recent decades, the U.S. current record equalization has been vigorously affected by worldwide exchange streams, with the continuous exchange deficiency bringing about a steady current record shortage. Profit on U.S. resources and speculations claimed abroad have a little part in the present record, and a surplus in this class is not sufficiently about to counterbalance the extensive exchange deficiency. Generally speaking, the present record shortage suggests that the estimation of the products and enterprises being bought from abroad by the United States surpasses the estimation of the merchandise and ventures being sold to outsiders. The U.S. current record shortfall augmented continuously since the 1990s and achieved an unsurpassed record and worldwide high of 5.8% of GDP in 2006. The deficiency contracted in the next years and achieved 2.4% in 2013. The change has been driven in expansive part by expanded residential oil generation.

The present record shortage is reflected by a capital record overflow. The net measure of capital inflows got in the United States from abroad makes it conceivable to fund the present record shortfall. Nonnatives keep on investing in U.S. resources and organizations, thus the net universal speculation position of the United States has developed after some time. The United States is by a long shot the top beneficiary of outside direct speculation (FDI). The U.S. economy got USD 166 billion in FDI in 2012, pushing the total stock to USD 2.7 trillion. Around 80% of FDI in the United States originates from an arrangement of only nine industrialized nations. The UK, Japan and the Netherlands are the top wellsprings of FDI in the U.S. The U.S. producing part draws around 40% of FDI.

United States Trade Structure

The U.S. is the second driving exporter of products and enterprises on the planet and the main driving merchant. The U.S. reliably runs an exchange deficiency, for the most part because of the reliance on outside oil to meet its vitality needs and high local interest for purchaser merchandise delivered abroad. In 2013, the United States recorded a USD 702 billion shortfall in exchange of merchandise, including a USD 232 billion deficiency in petroleum items. Then, the U.S. had a USD 231 billion surplus in exchange of administrations. The principle exchanging accomplices of the U.S. are Canada, China, Mexico and Japan. Canada is the primary goal for U.S. sends out, while China is the primary wellspring of imports. The exchange deficiency with China hit a record high USD 318 billion in 2013.

The U.S. assumes a noteworthy part in the worldwide exchange framework and is by and large seen as a defender of decreased exchange hindrances and unhindered commerce assentions. The United States at present has more than twelve facilitated commerce understandings set up. Among them are the North American Free Trade Agreement (NAFTA), which was made in conjunction with Canada and Mexico in 1994. In 2011, the United States consented to organized commerce arrangements with Panama, Colombia, and South Korea. The United States is additionally a dynamic individual from the World Trade Organization (WTO).

Export from the United States

In spite of the fact that the United States has lost some of its aggressive edge in late decades, material products still speak to 66% of its aggregate fares. The United States primarily trades high-esteem capital merchandise and fabricated items, including mechanical apparatus, planes, engine vehicles and chemicals. In 2013, the U.S. sent out USD 1.579 trillion in products.

The United States is the world's driving exporter of administrations. This incorporates money related and proficient business administrations and in addition other learning serious administrations. Travel, transportation and tourism administrations are likewise a noteworthy fare. The United States sent out a record high USD 682 billion of administrations in 2013, which spoke to around 33% of its fares.

Imports to the United States

Around 80% of aggregate imports conveyed to the United States from abroad are products. Around 15% of these imports are in the structure unrefined petroleum, fuel oil and petroleum items. Mechanical hardware, supplies and gear speak to another 15% of imported merchandise. Very nearly 25% of imported merchandise are capital products, for example, PCs, PC embellishments, hardware, restorative gear, and media communications gear. Customer products speak to another 25% of imported merchandise. Cellphones, pharmaceuticals, toys, family gear, materials, clothing, TVs, and footwear are the fundamental sorts of purchaser products imported to the United States. An extra 15% of imported merchandise are car vehicles, parts, and motors. Sustenance and drinks speak to just around 5% of imported products. Administrations speak to just 20% of aggregate imports, and are essentially money related administrations, and in addition travel and transportation.