HOW TO GET MUDRA LOAN AND DOCUMENTS REQUIRE FOR MUDRA LOAN AND PROVIDERS OF MUDRA LOAN AND BENEFITS OF MUDRA LOAN

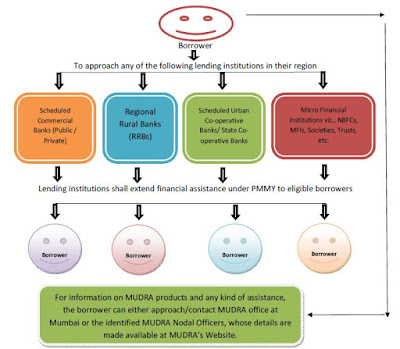

MUDRA is a very famous scheme of BJP government . To get

loan under this scheme or yojana , various public and private sector banks have

been given the responsibility to provide loans

under this scheme or yojana .

All Scheduled Banks

in public and private sectorare providing the loan .

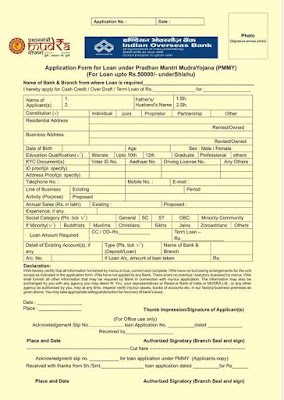

DOCUMENTS REQUIRED FOR MUDRA LOAN

1.Self attested proof of identity along with the loan

applicant 2 passport size photographs.

2.Quotation of items and machinery to purchased for the setup of the business.

3.Details of requirements suppliers and machineries as well as other

items to be purchased.

4.Identity of proprietorship of

business and business address and location along with copies of important certificates.

5.Proof of reserved category like SC, ST, OBC, etc .

BENEFITS OF MUDRA

LOAN OR MUDRA YOJANA

First off, no necessary collateral is require. There is also

not any kind of loan application fee .

But the main feature is the rate of interest which is only 1% which is almost

nothing as compared with other loans. It also provide various guidance and

advise to entrepreneurs and businessman various kind of things which is related

to their start up. This is also very helpful for upliftment of society and

growth of country.

Presently loans under Mudra Yojana are offered by:

27 Public Sector Banks(PSB)

17 Private Sector Banks

4 Co-operative banks

36 Microfinance Institutions

25 Non-Banking Financial Institutions

31 Regional Rural Banks(RRB)