What could be the effects of e wallets or mobile wallets like oxigen ,Paytm or freecharge on an economy ?

The e wallets or mobile wallets like paytm , freecharge,oxigen do not make

money or print money . In that logic they are no different

than your credit

card or debit card issued by a banking institution or financial institution .

They are basically pre paid instruments

use online payment gateway to pay actual

money which is used to buy real goods and services through electronic medium by

use of internet.Basically they are a part of IT(Information Technology) act 1999.

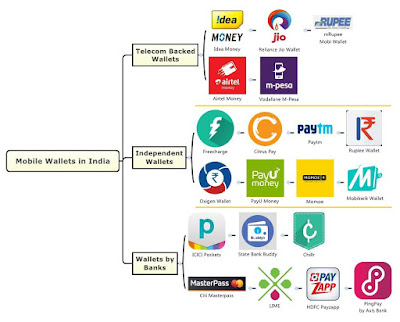

e wallets in India

These e wallets are not likely to have any effect on

inflation or NPA’s(non performing assets)/ real economy or currency markets.

But by altering any cash deal that world have gone unrecorded under it, it

would make such dealings noticeable and thus taxed. It play a very crucial in

controlling black money .

In India these mobile wallets are required to hold their

money in government approved securities or an bank account in a regular bank.

This keeps the money safe and unleveraged as divergent to a regular bank which

can influence their deposits several times over.

In certain African nations mobile apps like m-pesa actually

became superior than the banking sector which affect the constancy if their

financial sector. This is not likely to happen in India because India has a

much better banking sector and persistently high inflation makes keeping money safe

and sound in a mobile wallet instead of investing it expensive.

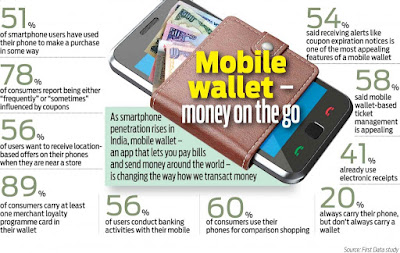

These are also very helpful for a developing country because

it made services more ease and flexible .They also make various services in

reach of various people either they belong to a remote areas too. They also

play a very important role in improving the GDP(Gross Domestic Product) and npa of a

country.