GST BILL (GOODS AND SERVICES TAX BILL)

ONE NATION ONE TAX

THE GST BILL (GOODS AND SERVICES TAX BILL) IS A VERY MAJOR REFORM FOR INDIAN ECONOMY BECAUSE IT RESTRUCTURE THE WHOLE ECONOMY AND FINANCIAL PLANNING .IT MAY LEAD TO A GREAT CHANGE IN INDIA GDP GROWTH.

Current Rate of GST may be 27%

|

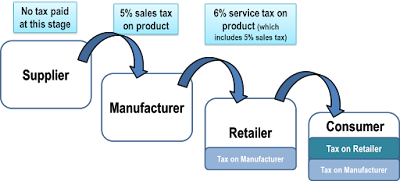

| CONDITION BEFORE GST |

Goods and Services Tax would be a inclusive indirect tax on production, sale and utilization of commodities and services all through India, to replace taxes levy by the Central and State governments. Goods and services tax would be levy and collected at each period of sale or purchase of commodities or services based on the input tax credit system.

This method allows GST-registered businesses to maintain tax credit to the value of GST they paid on purchase of commodities or services as part of their regular commercial movements. Taxable commodities and services are not differentiated from one another and are taxed at a single rate in a provide chain till the goods or services reach the consumer. Administrative liability would generally relax with a particular authority to levy tax on commodities and services.