NPA (NON PERFORMING ASSETS) IN BANKING

NPA (Non Performing Assets ) these are those assets or advances which not generate income to a bank.

Basically NPA are those loans and advances on which interest or repayment of principle or both remain outstanding for a period of more than two quarters (180 days) or 90 days . They put detrimental impact on the profitability , capital adequacy ratio and credibility of bank.

Basically NPA are those loans and advances on which interest or repayment of principle or both remain outstanding for a period of more than two quarters (180 days) or 90 days . They put detrimental impact on the profitability , capital adequacy ratio and credibility of bank.

TYPES OF NPAs

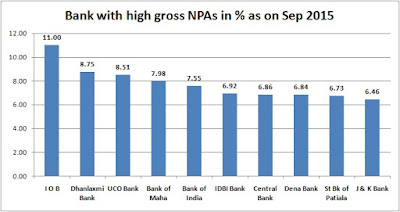

- GROSS NPA - GROSS NPAs are the addition of all loan assets that are classified as NPAs as per RBI guidelines as on balance sheet Gross NPA reflects the quality of loans made by banks. It consists of all the non standard assets like as sub-standard,doubtful and loss assets . GROSS NPA RATIO =GROSS NPAs / GROSS ADVANCES

- NET NPA- NET NPAs are those type NPAs in which the bank has deducted the provisoin regarding NPAs. It shows the actual burden of banks . NET NPAs = GROSS NPAs - PROVISIONS